What is Credit Score and How to Improve It in India?

What is Credit Score and How to Improve It in India?

Date : 03-10-2025

Posted By : Growmoreloans.com

What is Credit Score and How to Improve It in India?

A credit score is one of the most important financial numbers in today’s world, especially if you are looking for a personal loan, home loan, car loan, or even a credit card. In India, lenders use this score to evaluate your creditworthiness and repayment capacity before approving any kind of credit.

A credit score in India, such as a CIBIL score, is a three-digit number (typically 300-900) reflecting your creditworthiness based on your credit history and ability to repay debts. To improve it, pay all bills and EMIs on time, maintain a low credit utilization ratio (ideally under 30%), avoid applying for too many new credit accounts, and periodically review your credit report for errors.

But what exactly is a credit score, and how can you improve it to increase your chances of getting loans at low interest rates? Let’s understand in detail.

What is a Credit Score?

A credit score is a three-digit number ranging typically between 300 to 900 that reflects your credit history and repayment track record. The higher the score, the better your credit health.

In India, CIBIL, Experian, Equifax, and CRIF Highmark are the four credit bureaus authorized by the RBI (Reserve Bank of India) to generate credit reports. Among them, CIBIL score is the most widely recognized by banks and NBFCs.

Excellent Credit Score: 750 – 900 (Best chances for quick loan approvals and low interest rates)

Good Credit Score: 700 – 749 (Eligible for most loans, competitive interest rates)

Fair Credit Score: 650 – 699 (Loan approval possible but at higher rates of interest)

Poor Credit Score: Below 650 (Chances of loan rejection are high).

Factors That Influence Your Credit Score:

Repayment History: Making timely payments on loans, credit cards, and other debts is the most significant factor.

Credit Utilization Ratio: This is the amount of credit you are using compared to your total available credit. A high ratio can negatively impact your score.

Credit History Age: A longer history of responsible credit management demonstrates reliability.

Credit Mix: Having a healthy mix of secured (like a home loan) and unsecured (like a credit card) credit can improve your score.

Credit Inquiries: Too many applications for new credit in a short period can lower your score.

Why is Credit Score Important in India?

1. Loan Approval – Lenders rely on your credit score to decide whether to approve your application.

2. Interest Rates – Higher scores help you get loans at lower interest rates.

3. Credit Card Eligibility – Premium credit cards are offered only to individuals with a good score.

4. Negotiating Power – With an excellent score, you can negotiate better loan terms.

5. Employment and Renting – Some employers and landlords in India also check credit reports for background verification.

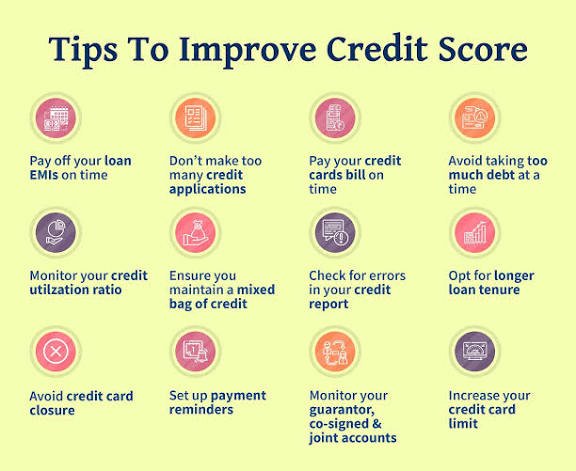

How to Improve Your Credit Score in India?

If your score is low, don’t worry. With consistent efforts, you can build and improve your credit score over time. Here are some proven tips:

1. Pay Your EMIs and Credit Card Bills on Time

Timely payment of EMIs and credit card dues is the most important factor. Even a single missed payment can hurt your score.

2. Maintain a Low Credit Utilization Ratio

Keep your credit card usage below 30% of the total limit. For example, if your limit is ₹1,00,000, try to use less than ₹30,000.

3. Avoid Multiple Loan Applications at Once

Each loan or credit card application generates a hard inquiry, which lowers your score if done frequently. Apply only when necessary.

4. Diversify Your Credit Mix

Having a balanced mix of secured loans (like home loan, car loan) and unsecured loans (like personal loan, credit card) shows stability to lenders.

5. Check Your Credit Report Regularly

Sometimes errors in your CIBIL report can affect your score. Reviewing it regularly helps you dispute and correct mistakes quickly.

6. Do Not Close Old Credit Cards

Older accounts add to your credit history length, which improves your score. Keep old cards active with minimal usage.

7. Settle Old Debts or Defaults

If you have unpaid dues or written-off loans, try to settle them. Clearing past debts boosts your creditworthiness.

How Long Does It Take to Improve a Credit Score?

Improving your credit score in India is not an overnight process. Depending on your financial discipline, it may take 6 to 12 months to see significant improvements. The key is consistent repayment, controlled spending, and monitoring your credit health.

Final Thoughts

A good credit score is like your financial passport in today’s lending environment. By maintaining financial discipline, paying bills on time, and monitoring your credit report regularly, you can build a strong CIBIL score and unlock access to affordable loans, credit cards, and financial opportunities in India.

Categories

- All Category

- Investment Opportunities

- Loans And Finance

- Business Opportunities

- Startup India

- Banking And Finance News

- Franchise & Dealership Network Development

- Real Estate (Residential, Commercial, Warehousing etc)

- Statutory Compliances & Taxation

- Hospitality Business Opportunity - Hotels, Resorts, Restaurants etc

- Jobs and Employment Opportunities

- Personal Finance

Latest Blogs

AU Small Finance Bank – Empowering Business Growth with Tailored Financial Solutions

Date : 09-11-2025

Posted By : Growmoreloans.com

Unsecured Business Loans up to ₹10 Crores under CGTMSE Scheme . No Collateral Required!

Date : 09-11-2025

Posted By : Growmoreloans.com

CGTMSE guaranteed Unsecured Working Capital Loans to MSMEs in India

Date : 02-11-2025

Posted By : Growmoreloans.com

Profectus Capital—Educational Institution Loans Made Simple

Date : 31-10-2025

Posted By : Growmoreloans.com

Credit Card Debt Trap: A Wake Up Call for Financial Discipline

Date : 29-10-2025

Posted By : Growmoreloans.com