How does RBI- India’s Central Bank -make more profit than Reliance + TCS + Infosys combined???

How does RBI- India’s Central Bank -make more profit than Reliance + TCS + Infosys combined???

Date : 09-06-2025

Posted By : Intellex Strategic Consulting Private Limited

How does RBI — India’s Central Bank — make more profit than Reliance + TCS + Infosys combined?

It doesn’t sell anything.

It’s not listed on the stock market.

It doesn’t give home loans or credit cards.

Still… it just made a record ₹2.69 lakh crore profit.

Here’s how RBI, a “non-profit” institution, actually runs a money-making machine

⸻

1️⃣ Interest from Government Bonds

RBI holds ₹51 lakh crore in government securities (G-Secs).

These are like massive FDs that pay 6.5% interest.

That’s ₹3.3 lakh crore income — just by holding them!

⸻

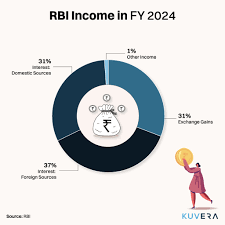

2️⃣ Returns from Foreign Reserves

RBI manages $640 billion worth of assets — like US & Euro bonds, gold, and IMF credits.

As global interest rates rise, returns increase.

Even a 3% return = ₹1.6 lakh crore

Add currency trading profits = jackpot!

⸻

3️⃣ Profit from Printing Money (Seigniorage)

To print ₹100, RBI spends only ₹2.

Remaining ₹98 is its gain — called seigniorage.

With ₹34 lakh crore of cash in circulation, this adds up to ₹60,000+ crore every year.

⸻

4️⃣ Bond Trading Gains (Open Market Operations)

RBI buys and sells bonds to manage liquidity in the market.

Sometimes it earns by selling high or booking capital gains.

FY24 gains? ₹30,000–₹40,000 crore

⸻

5️⃣ Lending to Banks (Repo Operations)

Banks borrow from RBI at 6.5% repo rate for short-term needs.

RBI earns interest — just like any lender.

Adds ₹8,000–₹10,000 crore annually.

⸻

6️⃣ Fees, Penalties & Settlement Charges

RBI charges:

• License fees to NBFCs & banks

• Penalties for non-compliance

• RTGS & NEFT usage charges

Not huge, but every crore helps.

⸻

7️⃣ Gold Gains & Subsidiary Dividends

• Revaluation profit on gold

• Dividends from its own companies (like BRBNMPL)

• Managing sovereign foreign borrowings

⸻

RBI’s Balance Sheet = ₹70+ lakh crore

That’s 26% of India’s GDP.

No loans. No sales team. No ads.

Just solid policy, massive scale, and a smart income model.

India’s most profitable institution… quietly doing its job.

Sudheendra Kumar ( Mobile /WhatsApp: 91-9820088394)

Follow us on LinkedIn:

https://www.linkedin.com/

https://www.linkedin.com/

https://www.linkedin.com/

https://www.linkedin.com/

Categories

- All Category

- Investment Opportunities

- Loans And Finance

- Business Opportunities

- Startup India

- Banking And Finance News

- Franchise & Dealership Network Development

- Real Estate (Residential, Commercial, Warehousing etc)

- Statutory Compliances & Taxation

- Hospitality Business Opportunity - Hotels, Resorts, Restaurants etc

- Jobs and Employment Opportunities

- Personal Finance

Latest Blogs

AU Small Finance Bank – Empowering Business Growth with Tailored Financial Solutions

Date : 09-11-2025

Posted By : Growmoreloans.com

Unsecured Business Loans up to ₹10 Crores under CGTMSE Scheme . No Collateral Required!

Date : 09-11-2025

Posted By : Growmoreloans.com

CGTMSE guaranteed Unsecured Working Capital Loans to MSMEs in India

Date : 02-11-2025

Posted By : Growmoreloans.com

Profectus Capital—Educational Institution Loans Made Simple

Date : 31-10-2025

Posted By : Growmoreloans.com

Credit Card Debt Trap: A Wake Up Call for Financial Discipline

Date : 29-10-2025

Posted By : Growmoreloans.com